Welcome to My Chubby FIRE Quest: Why I'm Chasing $5M

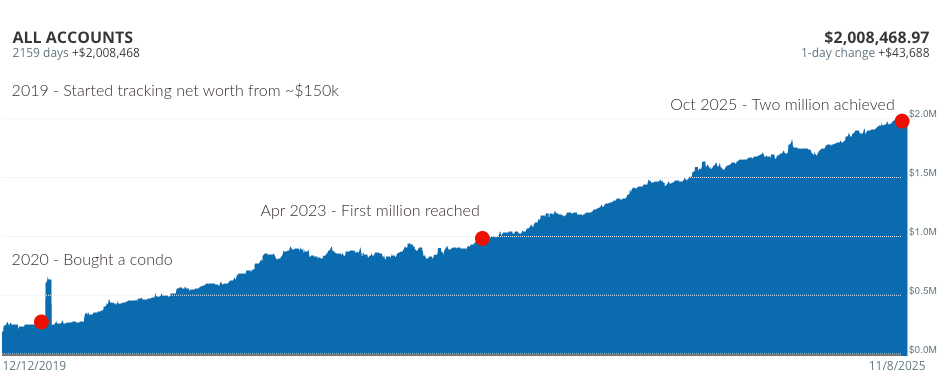

My name is Steven. Two years ago, I hit a net worth of $1 million. Last month, I crossed $2 million.

And I still feel trapped.

On paper, I’ve made it. I’m in my late 30s, holding a managerial role in the tech industry on the West Coast, with a great income and a net worth that puts me in a tiny fraction of the population. I should feel secure, relaxed, maybe even retired. But I don’t. The truth is, I’m miserable in my corporate job—the endless meetings, the politics, the constant pressure. The life I want feels a million miles away.

What is that life? It’s simple. It’s having the energy after a morning run to read a book, not just scroll through emails. It’s the freedom to pack a bag and spend three months exploring another country, immersing myself in a different culture, visiting family overseas without a countdown clock ticking towards a return flight. It’s about learning new things just for the joy of it, not for the next promotion.

It’s about owning my time. And to do that, I realized I don’t just need a number in a spreadsheet. I need a plan. And a much bigger number than I ever imagined.

I need $5 million. This is my story of why.

Finding the “Just Right” FIRE: Lean, Fat, and Chubby

Before I figured out my number, I had to figure out what game I was even playing. The whole "Financial Independence, Retire Early" (FIRE) thing isn't just one idea. It's a whole menu of options, and I had to find the one that actually fit my life.

Lean FIRE is the path of the hardcore minimalist. It’s about aggressive saving, slashing expenses to the bone, and retiring on a shoestring budget. While I admire the discipline, it feels too fragile. One unexpected life event, one shift in priorities, and you could be forced right back into the workforce. It requires sacrifices I’m not willing to make forever.

On the other end is Fat FIRE, the dream of a lavish, no-compromise retirement. Think luxury travel, expensive hobbies, and a multi-million dollar estate. Honestly, the thought of the sacrifices required to hit a $10M+ target is exhausting. I don’t want a life of extravagance; I just want a life of freedom.

And so, I landed on Chubby FIRE.

For me, Chubby FIRE is the perfect middle ground. It’s not about sacrifice or excess. It’s about building a life that is comfortable, sustainable, and secure. It means being able to afford a modest home on the West Coast, cover top-tier health insurance without blinking, support my aging parents, and enjoy my hobbies without obsessively tracking every penny. It’s the sweet spot that provides peace of mind.

The Origin Story: When $2 Million Isn't Enough

My journey to this realization was a slow burn. Hitting my first million was a huge milestone, a massive mental relief. For the first time, I breathed out. I was officially a millionaire. But my life didn't change. I was still living in a small condo, driving an old car, and saving obsessively.

The goalpost moved. The new target became $2M.

But when I hit that number, the feeling wasn't euphoria. It was… nothing. I still didn’t feel anywhere close to being able to walk away. The numbers just didn’t work.

The chart shows the progress, but the feeling didn't match the numbers. Hitting $2M was a milestone, not a destination.

That’s when I knew I had to stop chasing arbitrary milestones and start from the end. I sat down and imagined the life I actually wanted. What would it cost to live a comfortable, worry-free life in a high-cost-of-living area, forever?

I started adding it up. Not with a vague sense of "a lot," but with real numbers.

The Real Math Behind My $5 Million Target

When you break it down, the path becomes clear. Here’s the approximate annual spending I calculated for a comfortable, secure retirement on the West Coast:

- Living Expenses: $55,000. This covers all the basics: groceries, utilities, transportation, and day-to-day spending.

- Housing (Condo): $45,000. This is the projected annual cost for the condo, covering the mortgage, property taxes, HOA fees, insurance, and maintenance.

- Healthcare: $32,000. A crucial and often underestimated expense for early retirees before Medicare kicks in. This is a non-negotiable safety net.

- Travel: $12,000. One or two meaningful trips a year, without having to pinch pennies.

- Taxes: $9,000. Because even in retirement, taxes are a certainty.

Total Annual Need: $153,000

Using the common 3-3.5% safe withdrawal rate—a conservative percentage to ensure the money lasts a lifetime—the math is straightforward. To safely generate over $150,000 a year, you need a nest egg of around $5 million.

Suddenly, it all clicked. This wasn't a dream number. It was my real number. My north star. And by the time I get there in 5-7 years, inflation will likely push that annual need to $165k-$170k, making the $5M target even more critical.

Join the Quest

This blog is my public commitment to that goal. It’s a chronicle of the grind from $2M to $5M. It’s for the high-earner who feels trapped on the corporate hamster wheel, who makes good money but sees freedom as a distant dream.

I’ll share everything: the real numbers, the investment strategies, the tools I use, and the trade-offs I make. No fluff, no gatekeeping. Just a transparent, real-time look at what it takes to actually buy your time back.

If this sounds like you, subscribe and follow along. Let’s figure this out together.

Member discussion