Max Contribution to 401k and Mega Backdoor Roth in 2026

My coworkers are constantly chasing the latest spending trend. Tesla accessories, Peloton subscriptions, every streaming app imaginable—you name it. I just sit there, quiet. They know I'm the "cautious with money" guy. Last week someone actually said: "Dude, you can afford a $10 TIDAL subscription, don't be cheap." I laughed. While they're buying toys, I'm maxing out accounts that literally give me free money. But sure, call me cheap.

Let me paint you a picture: the average American salary is around $64k, and most people live on it just fine. Yet here we are, tech workers making $200k+, spending freely on gadgets and subscriptions, then complaining about feeling "broke" when we actually try to max out our benefits. It's all perception, folks. And that perception is costing us serious money.

TL;DR

I'm maxing out five powerful workplace and investment accounts: 401(k), HSA, Mega Backdoor Roth, ESPP, and Backdoor Roth IRA. As high earners, we have access to tools that generate immediate returns (ESPP) or massive tax savings (401k/HSA), yet most of us only use the basics.

The Real Numbers Behind My Setup

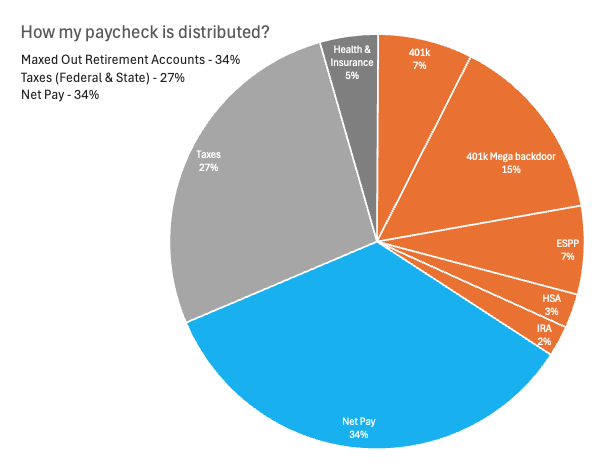

Here's how my compensation breaks down:

- Base: ~$250k

- Bonus: ~$50k

- Total: ~$300k

Now here's where it gets interesting. My company offers the holy grail of benefits – and I bet yours does too. Most of my coworkers? They do the minimum required contributions and think they're covered. Meanwhile, they're literally walking past free money every single day.

Where My $300k Actually Goes

The Five Pillars of My Strategy (2026 Limits)

Here's exactly how I maximize all five accounts to squeeze every drop of value from my compensation package – complete with the 2026 limits and my actual strategy for each:

Quick Overview: All Five Accounts at a Glance

| Account | My 2026 Contribution | Why It Matters | Est. Annual Value |

|---|---|---|---|

| 401(k) | $24,500 | Reduces taxable income | $10,000 Tax Saved |

| Mega Backdoor | ~$40,000¹ | Massive Roth growth | Future Growth |

| HSA | $8,750 | Triple tax-free | $3,675 Tax Saved |

| ESPP | $21,250 (Cash) | Instant 15% discount | $3,750 Profit |

| Backdoor IRA | $7,500 | Extra Roth space | Future Growth |

| TOTAL | ~$102,000 | ~$17,425 |

¹ After-tax 401(k) space: $72,000 total limit - $24,500 employee contribution - Employer Match (~$7.5k)

² Tax-free in, tax-free growth, tax-free out (for medical)

My Execution Strategy

1. Traditional 401(k): The Foundation (IRS source)

I max out at $24,500 with even contributions throughout the year to ensure I get the full employer match. At my 42% marginal tax rate (California), this saves ~$10k annually. Simple target-date fund, nothing fancy.

Pro tip: Spread contributions evenly to capture every dollar of employer match – missing even one paycheck of match is leaving money on the table.

2. Mega Backdoor Roth: The Secret Weapon

Since this is my biggest contribution bucket, I set a reasonable amount and spread it evenly throughout the year. I contribute after-tax dollars with auto-conversions to Roth to avoid taxable gains.

Pro tip: Only ~40% of large companies offer this. Check yours ASAP – it's ~$40k annually in Roth savings with no income restrictions.

3. HSA: Triple Tax Advantage (IRS source)

Max family contribution of $8,750, spread throughout the year to get the full employer match. I invest everything in index funds, pay medical expenses out-of-pocket, and save receipts for tax-free reimbursement later.

Pro tip: This is the ONLY account that is completely tax-free: tax-free in, tax-free growth, and tax-free out. After 65, it becomes another IRA.

4. ESPP: The "Free Money" Machine (Not Tax-Advantaged, Just Profitable) (IRS source)

Unlike the other accounts, this isn't about tax savings—it's about arbitrage. The $25,000 limit is based on the Fair Market Value (FMV) of the stock, which means you actually contribute roughly $21,250 cash to buy $25,000 worth of stock. I max out within the first 5-6 months to get the 15% discount, then immediately sell and convert to index ETFs.

Pro tip: Think of this as a guaranteed 15% raise on $25k of your income. Sell immediately and convert to index funds. Concentration risk is real when you're already betting your career and salary on this company; don't bet your retirement too.

5. Backdoor Roth IRA: Extra Tax-Free Space (IRS source)

Max out traditional IRA with $7,500, then immediately backdoor to Roth IRA. Simple workaround for high earners over income limits ($153k single, $242k married).

Pro tip: Watch the pro-rata rule – roll any existing pre-tax IRA balances into your 401(k) first to avoid partial taxation.

The Tax Arbitrage Only High Earners Can Play

Many say "I can't lock my money away." But here's the reality:

As high earners, we're in the highest tax brackets today (35-42% federal + state) but will likely be in the 0-15% bracket in retirement. That's the arbitrage opportunity.

By deferring taxes through pre-tax 401(k) and HSA contributions now, and letting Roth accounts grow tax-free forever, you're potentially saving hundreds of thousands over your lifetime. Every year you delay maxing these accounts is choosing to pay high taxes now instead of low (or no) taxes later.

"But what if I need the money early?" There are penalty-free strategies: Roth Conversion Ladders and 72(t) distributions. Learn them before you need them.

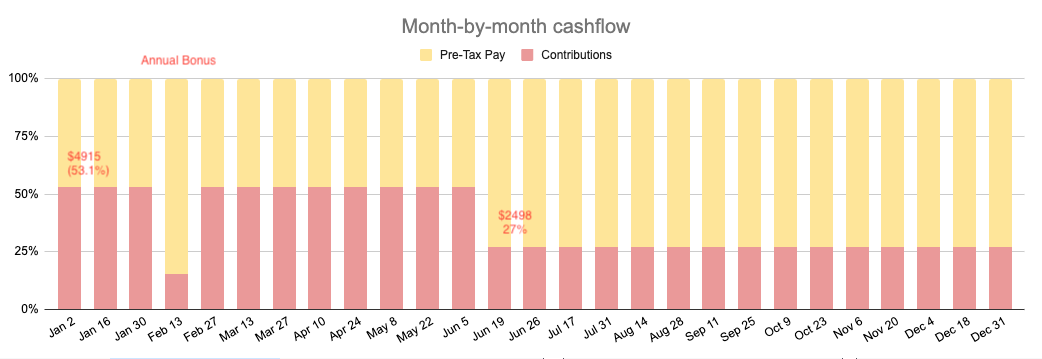

The Hard Reality of Front-Loading (With My Actual Numbers)

Let me show you what happens to your paycheck when you front-load:

My Actual 2024 Take-Home Pay: The Front-Loading Reality

Phase 1: Front-Loading Phase (Jan - May)

- Contributing 50%+ of gross income to retirement accounts

- Aggressively maxing out: ESPP (12 paychecks), IRA

- Even contributions to 401(k), HSA, and Mega Backdoor

Phase 2: Second half of the year (June - Dec)

- ESPP and IRA complete – contribution rate normalizes

- Continuing steady contributions ~27% 401(k), HSA, and Mega Backdoor through year-end

- The payoff: From barely surviving to finally having some extra cash flow again

The first 5 months are challenging – watching 50%+ of your gross paycheck disappear into retirement accounts tests your commitment. But this temporary reduction creates permanent wealth.

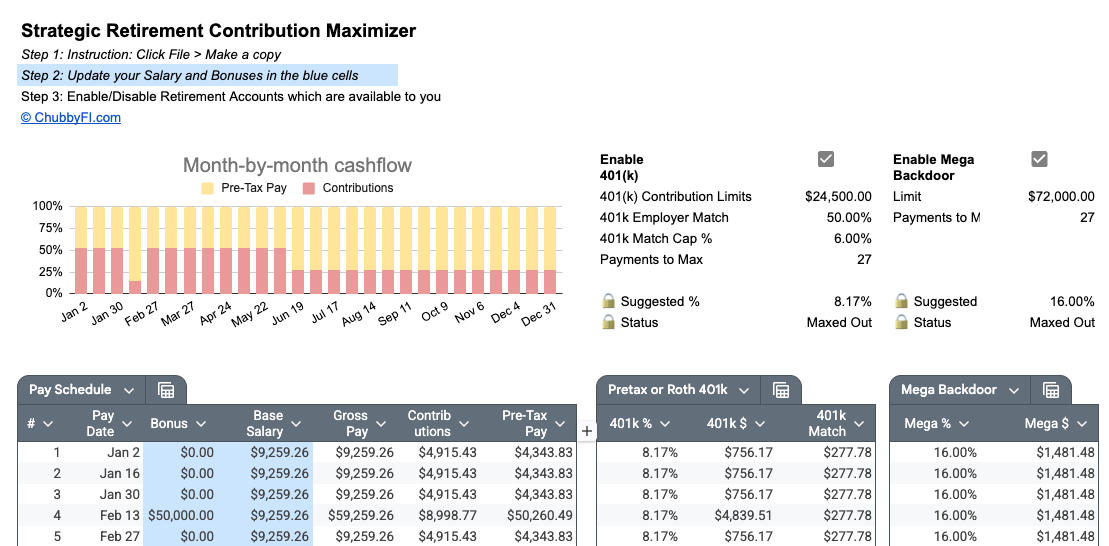

My Planning Spreadsheet

My 2026 Front-Loading Calculator (Google Sheets)

You can use the spreadsheet template to plan and calculate contribution percentages into retirement accounts.

Your 2026 Action Plan (Start Today, Not January)

Forget generic advice. Here's your exact playbook using my battle-tested spreadsheet:

Get the Spreadsheet (2 minutes)

Download my 2026 Max-Out Calculator

It's a short-term sacrifice for long-term gain. The spreadsheet helps you see exactly how this strategy works with your own numbers.

Get the spreadsheet now and find out. Your financial independence is waiting.

Note: This is based on my personal experience and projected 2026 IRS contribution limits. Tax situations vary. Always consult with a financial advisor or tax professional before making major financial decisions.

Member discussion