Modeling My Path to $5M: A Projection Lab Deep Dive

For the longest time, I had an abstract number in my head: $2 million. That was it. The magic figure that meant I could retire. But reality, as it turns out, is a little more complicated. Without a proper, hard look at the numbers, "your number" is just a guess. And guessing with your future is a risky game.

It wasn't until I started putting my goals into a projected timeline that I felt a true sense of confidence. Seeing the path laid out, even with all its variables and uncertainties, changed everything.

The First Eye-Opener: My Real Retirement Number

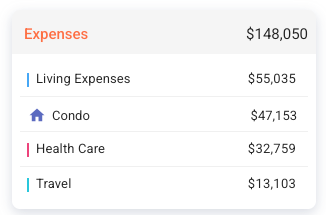

The first shock to the system came when I tallied up my actual, projected retirement expenses. It wasn't a vague estimate; it was a hard look at everything from healthcare and inflation to the hidden costs of homeownership like HOA fees and taxes.

The number staring back at me was over $150,000 a year. At a bare minimum.

That number made one thing crystal clear: my abstract $2M goal wasn't going to cut it. Not even close. This is where a tool like Projection Lab became essential. It helped me figure out this number and, more importantly, what to do about it.

From a Fuzzy Dream to a Concrete Plan

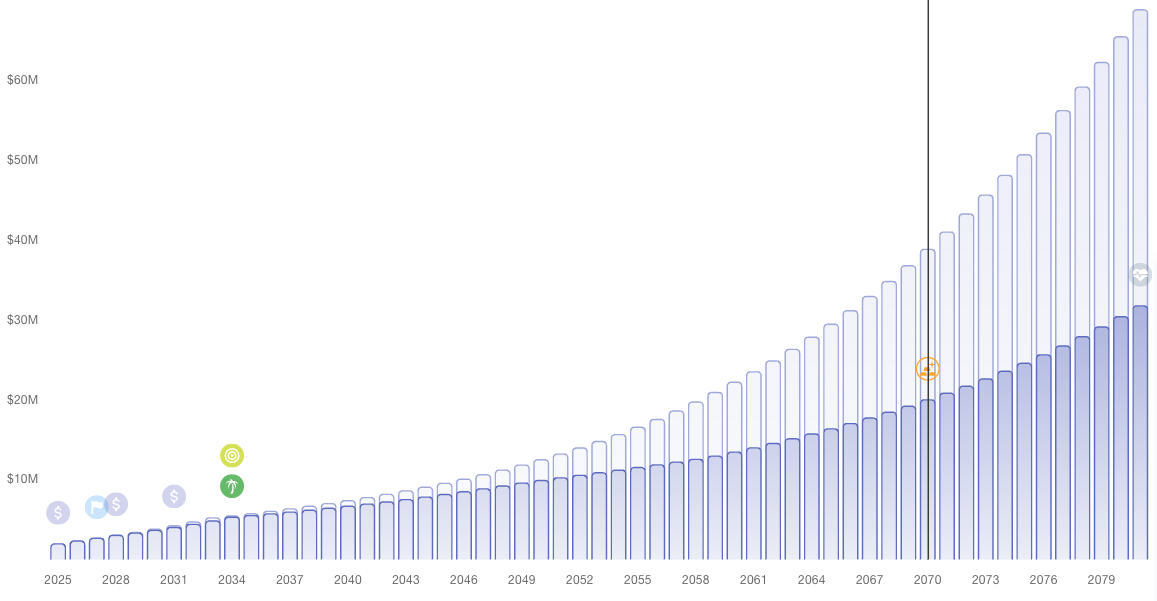

Plugging that expense number into a real model was the next step. The result was my first true projection, a viable path to not just retirement, but to my Chubby FIRE goal of $5 million. According to the plan, I could hit that mark by 2033.

This wasn't just a chart; it was a roadmap. It accounted for inflation, portfolio growth, and gave me a tangible target. But it also gave me a new insight: if I wanted to accelerate things, I had to get serious about savings. My new, ambitious goal became reaching that $5M milestone not by 2033, but by 2030.

The Million-Dollar "What If?"

This is where the real "deep dive" began. To shave three years off my timeline, I had to understand the long-term impact of major life decisions. Projection Lab's ability to run and compare scenarios was a game-changer.

For example, I'd always thought I'd buy a house, maybe a $1M - 1.5M place (Average home values in my neighborhood), once I hit the $3M net worth mark. It seemed reasonable. But when I plugged that single decision into the model, the long-term difference was staggering.

The comparison was stark. While my retirement and Chubby FIRE dates weren't drastically affected, the dream of ever reaching FAT FIRE (roughly $10M in today's money) was completely wiped out. That one purchase, decades earlier, would have capped my financial ceiling. Seeing it laid out like that opened my eyes.

My Takeaways and Next Steps

This modeling exercise didn't just give me data; it gave me clarity and a set of guiding principles for the next five years.

- Live Simply for Now: The fancy house can wait. The freedom and security of hitting my number are more important.

- No Major Moves, Just Focus: The primary goal is the $5M milestone. Everything else is a distraction until I get there.

- Race Against Inflation: Reaching the goal sooner is critical. The future value of money is a real, tangible factor, and the sooner I get there, the more powerful each dollar will be.

- Prioritize Savings and Investments: This is the engine of the plan. Every dollar I can save and invest now is fuel to shorten the timeline from 2033 to 2030.

Stop Guessing, Start Planning

If you're still holding onto an abstract number for your future, I encourage you to dig deeper. Stress-test your plan. Use the tools available to you to turn that fuzzy dream into a concrete path. It’s the difference between hoping for a secure future and actively building one.

Member discussion