November 2025 Net Worth Update: The Boring Middle is Where the Magic Happens

November saw no major changes. My primary goal was simply to keep expenses under control while continuing to max out my retirement and benefit accounts. It was a month of execution—the "boring middle" of the journey to Financial Independence where the real work gets done.

Quick TL;DR:

- Total Net Worth: $1,999,270 (up $15,111 or 0.76% from last month)

- Key Driver: Consistent contributions to retirement accounts and disciplined spending, despite a relatively flat market.

- Milestone Alert: Knocking on the door of $2,000,000 again—literally less than $700 away.

- FI Progress: 40% toward my $5M goal (based on a 3% withdrawal rate and $150,000 annual expenses).

Here’s a detailed, transparent look at where things stand.

The Bottom Line: November 2025

| Metric | Value | Change Since Last Month |

|---|---|---|

| Assets | $2,354,550 | +$13,793 |

| Liabilities | ($355,280) | -$1,318 |

| Total Net Worth | $1,999,270 | +$15,111 |

A Look at the Assets: The $2.35M Breakdown

Assets grew steadily this month. I continued to prioritize tax-advantaged accounts, maxing out what I can in the 401k and Mega Backdoor Roth.

A visual breakdown of my asset allocation as of November 30, 2025.

- Taxable Brokerage Accounts: ~$849,000

- Slight dip in total value compared to last month, primarily due to market fluctuations and some cash movements.

- Retirement Accounts (401k, IRA): ~$577,000

- Growth driven by $4,702 in fresh contributions (Employer + Employee).

- Cash & Equivalents: ~$232,000

- Maintaining a healthy cash buffer as part of my defensive allocation.

- Real Estate & Business Interests: ~$671,000

- Valuations held steady (based on Zillow estimate). I've grouped my small business and other illiquid holdings here as they represent non-market-correlated "hard" value.

- Other (Cryptocurrency): ~$20,000

- Holding steady.

The Other Side: Liabilities

Debt paydown continues on autopilot. The mortgage principal ticks down slowly, and the M1 loan remains manageable.

- Mortgage: ($334,420)

- Remaining balance on the condo.

- M1 Loan: (~$20,000)

- Remaining balance (down from ~$50k earlier this year). This loan was used for investing in a small local business managed by my wife.

- Credit Cards: $0

- Paid in full.

The Engine: Income & Spending

This is where I'm most proud of November. Last month, I confessed that my spending had crept up to ~$7,200 and set a public goal to get it back under the $5.5k-$6k range.

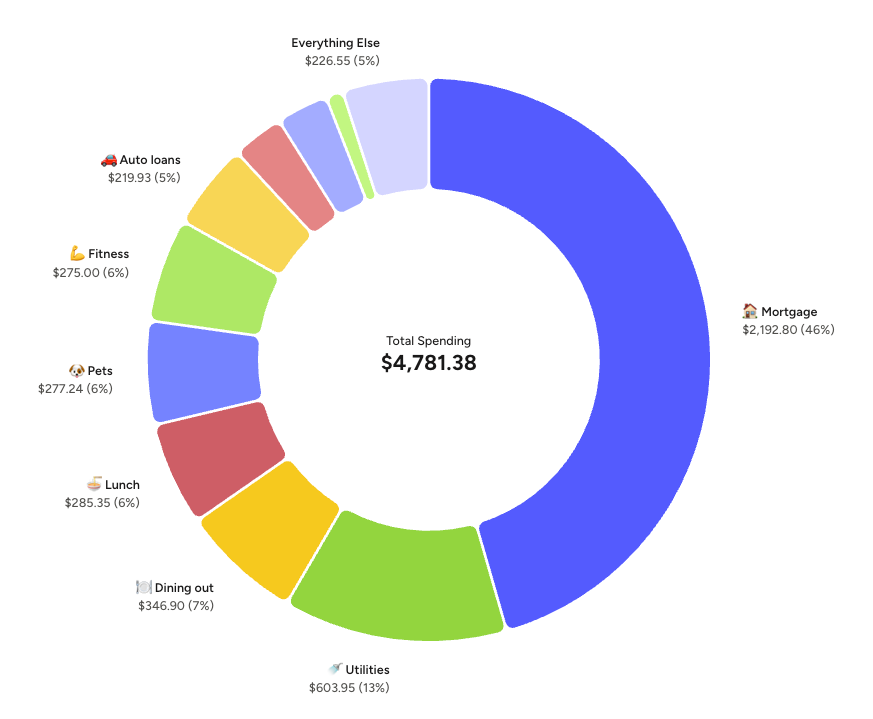

I crushed that goal. Total spending came in at $4,781.

It required saying "no" to a few things and being more mindful about dining out, but seeing the number start with a "4" is incredible. It's well below my target range.

- Monthly Gross Income: ~$19,311

- Monthly Post-Tax Income: ~$8,918

- Monthly Spending: ~$4,781

- Monthly Savings (Cash): ~$1,050

- Retirement Contributions: ~$4,702

- Savings Rate: ~30% (Total saved/invested vs Gross)

(Note: The significant gap between Gross and Post-Tax income is driven by taxes and heavy pre-tax 401k/benefit deductions—that money isn't disappearing, it's just being put to work before it hits my account.)

A snapshot of my spending breakdown. The discipline is in the details: "Wants" were kept to just 14% of total outflows, while the vast majority went to fixed bills and savings.

Reflections & The Road Ahead

November was a "heads down" month. It’s easy to get excited when you hit a big round number or buy a new gadget. It’s harder to stay excited about simply sticking to the budget and making the transfer.

But looking at the numbers, the strategy is working.

- Spending is under control. Keeping expenses low isn't just about saving money; it allows me to fund future months. This is crucial for early 2026, when I plan to front-load my retirement accounts. My paychecks will be lighter during those first few months, so building this buffer now prepares me for that cash flow dip and the upcoming tax season.

- Retirement accounts are being fed aggressively. Contributing over $4.7k in a single month is doing the heavy lifting for long-term growth.

- Emergency Fund is Building. I'm continuing to focus on building a true emergency fund in YNAB, aiming to have the next 6 months of expenses fully funded.

- Net Worth is hovering at the $2M door.

For December, the plan is more of the same. I expect spending might tick up slightly with the holidays, but the goal is to keep the core expenses dialed in. I'm ending the year with momentum and looking forward to finally hitting that $2M number in December.

Join the Quest

This blog is my public commitment to the grind from $2M to $5M. If you're a high-earner who feels trapped on the corporate hamster wheel, subscribe and follow along. Let’s figure this out together.

Member discussion