My 2026 One-Page Financial Plan

Everyone warns you that the first million is the hardest. They’re right about the math, but they’re wrong about the psychology.

The hardest part isn’t the beginning. It’s the middle.

When you have $100k, you’re hungry. You track every latte, you maximize every dollar, and you are singularly focused on escape. But when you hit $1.5M? You enter the Zone of Complacency.

You have enough money to feel rich. You can book the $20k vacation without checking your balance. You can let your monthly spend drift up to $7k because "it’s fine." You have the spending habits of a wealthy person, but you still have the calendar of an employee.

That was my 2025. It was a year of massive growth, but also a year of dangerous drift. Here is the review of a year where I made $441k, almost lost the plot, and how I’m correcting course for 2026.

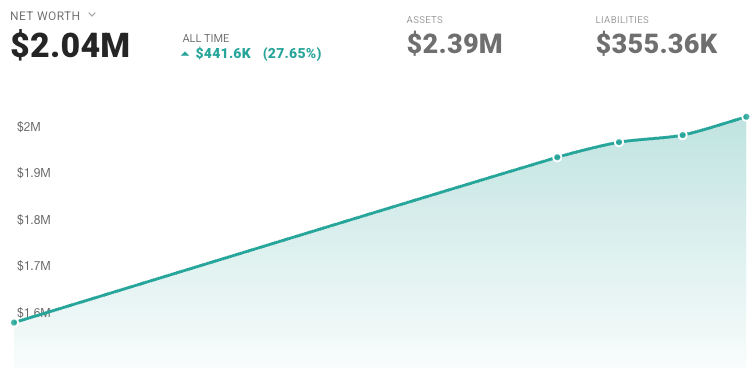

The Scoreboard: 2025 By The Numbers

Let’s start with the good news. Despite the mid-year drift, the compounding engine did its job. For the first time, my portfolio worked harder than I did.

- Start of Year (Dec 31, 2024): $1.6M

- End of Year (Jan 3, 2026): $2.04M

- Total Growth: +$441,600 (+27.65%)

The breakdown of that growth is the real story:

- New Contributions: ~$177,500 (My savings + Employer match/RSU)

- Pure Market Growth: ~$264,100

I crossed the $2 million mark in December. Seeing a "2" at the front of the net worth number is surreal, but what’s more important is the velocity. It took me 6 years to grind out the first million. The second million took just 2 years and 6 months.

The first million was discipline. The second million was momentum.

Here is the current breakdown:

| Asset Class | Value |

|---|---|

| Taxable Investments | $865.1K |

| Real Estate Equity | $336.7K |

| Tax-Deferred (401k/IRA) | $322.7K |

| Tax-Free (Roth) | $273.2K |

| Cash | $241.2K |

| Crypto | $20.8K |

| Liabilities | ($355.4K) |

| Total Net Worth | $2,041,750 |

The Trap: Why $1.5M is Dangerous

If the numbers are so good, why do I feel like I failed?

Because in the middle of 2025, I got lazy. Around the $1.5M mark, I took my foot off the gas. I stopped tracking. I told myself "I deserve it" way too often.

My monthly spend crept up from a tight $4-5k to a bloated $7-8k. I blew $20,000 on travel and $40,000 on a car upgrade—lifestyle upgrades that I can barely remember now.

That’s $60,000 of missed opportunity.

The upgrades felt nice. Cruising in a luxury car is definitely better than driving a beater. But every $1,000 I spent wasn't just money gone; it was time added to my sentence.

That $60k cost me months of freedom. Months of meetings, politics, and stress.

Was it worth it? No. Would I have been okay without it? Definitely.

Do I want to continue working 9-5 just to pay for a slightly nicer ride? No, no, no. It will come, it can wait.

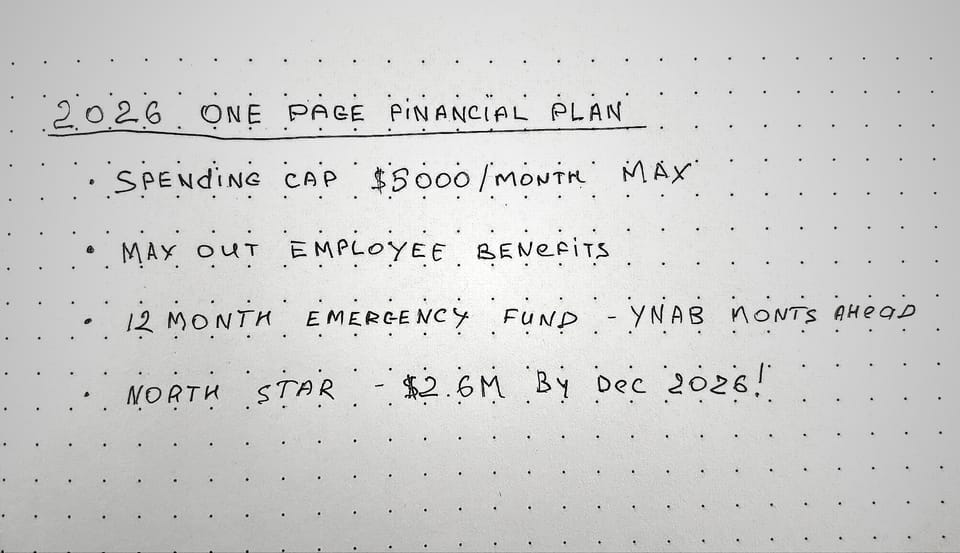

The Solution: My 2026 One-Page Financial Plan

I need a hard reset. Willpower isn't enough; I need a system that forces discipline even when I don't feel like it.

I’ve condensed my entire strategy for 2026 into a single page. No complex spreadsheets, just four non-negotiable rules.

1. The Spending Cap

Rule: Maximum $5,000 / month. No exceptions.

Everything else is noise. If I can't live a happy, fulfilled life on $60k post-tax (plus a paid-off condo), then the problem isn't money—it's me.

2. Artificial Scarcity (The Front-Load)

Rule: 100% of 401k and Mega Backdoor Roth is maxed out.

I am going to front-load ESPP and max out all retirement accounts.

3. The Windfall Protocol

Rule: 100% of Bonuses & Tax Refunds -> True Emergency Fund (Cash).

Windfalls are the enemy of discipline. It’s too easy to treat a bonus as "free money." In 2026, I am building a fortress. My goal is a 12-month cash runway (~$40k). This buys me peace of mind and protects the portfolio from needing to be sold if the market dips.

4. The North Star

Goal: $2.6M by Dec 31, 2026.

My goal hasn't changed—I'm still chasing a "Chubby" retirement ($5M). But I am changing the pace. I am done drifting. I am sprinting.

Join the Quest

This blog is my public commitment to the grind from $2M to $5M. If you’re tired of the corporate hamster wheel and want to see the real math behind the exit, subscribe. Let’s figure this out together.

Member discussion