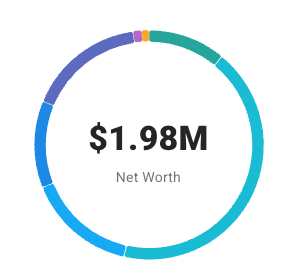

October 2025 Net Worth Update: Crossing the $2M Threshold

A brief personal update about the month. October was a month of milestones and contradictions. For the first time, my net worth crossed the $2,000,000 mark—a goal that felt monumental. Yet, by the end of the month, the market's fluctuations brought me just below it. It was a powerful reminder that this journey is not a straight line up.

Quick TL;DR:

- Total Net Worth: $1,984,159 (up $32,362 or 1.66% from last month)

- Key Driver: A mix of RSU vesting, 401k contributions, and significant debt reduction, offset by strategic portfolio reallocation.

- Milestone Alert: Crossed the $2,000,000 mark for the first time mid-month!

- FI Progress: 39.7% toward my $5M goal (based on a 3% withdrawal rate and $150,000 annual expenses).

Here’s a detailed, transparent look at where things stand.

The Bottom Line: October 2025

| Metric | Value | Change Since Last Month |

|---|---|---|

| Net Worth | $1,984,159 | +$32,362 |

| Assets | $2,340,757 | +$3,004 |

| Liabilities | ($356,598) | -$29,358 |

A Look at the Assets: The $2.34M Breakdown

October was a month of active management. While the overall market saw some gains, my focus was on de-risking and optimizing. I sold a significant position in Alibaba and reallocated the funds into gold (GLD), emerging markets (VWO), and cash. This reflects my current concern that the US market may be over-inflated by AI trends while broader economic indicators, like the job market, show signs of weakness. This reallocation, combined with selling some assets to pay down debt, resulted in a slight dip in my taxable brokerage account value, even as my net worth climbed.

A visual breakdown of my asset allocation as of October 31, 2025.

- Taxable Brokerage Accounts: $862,986

- Value decreased slightly due to the sale of assets to pay down my M1 loan and the reallocation from individual stocks to ETFs and cash.

- Retirement Accounts (401k, IRA): $560,707

- Increased by ~$4,805 in contributions.

- Cash & Equivalents: $221,384

- Cash position increased as part of my defensive reallocation strategy.

- Real Estate (Primary Residence Estimate): $671,100

- Valuation remained stable for the month.

- Other (Cryptocurrency): $24,580

- No changes this month; holding steady.

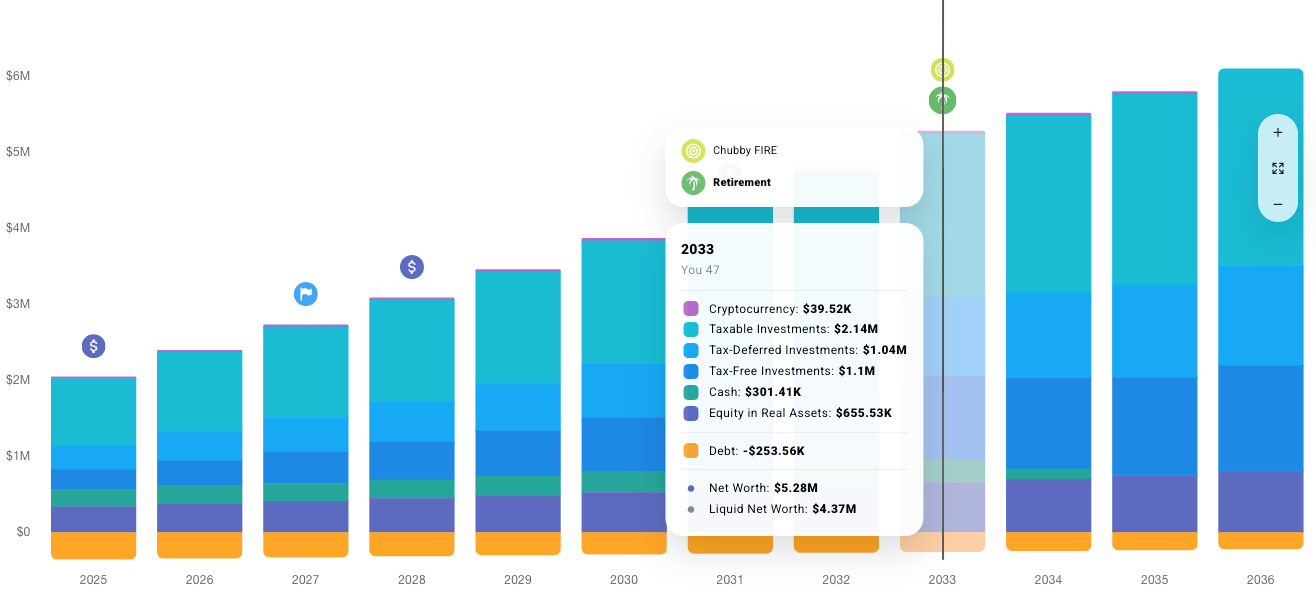

My net worth projection, starting from the current month.

The Other Side: Liabilities

The big story this month was debt reduction. I used a portion of my vested RSUs to pay down my M1 margin loan from over $50,000 to just over $20,000. This was a major goal, and it feels great to have significantly reduced that liability.

- Mortgage: ($335,922)

- Remaining balance on the condo.

- M1 Loan: ($20,676)

- Remaining balance after a significant paydown.

- Credit Cards: $0

- Paid in full.

The Engine: Income & Spending

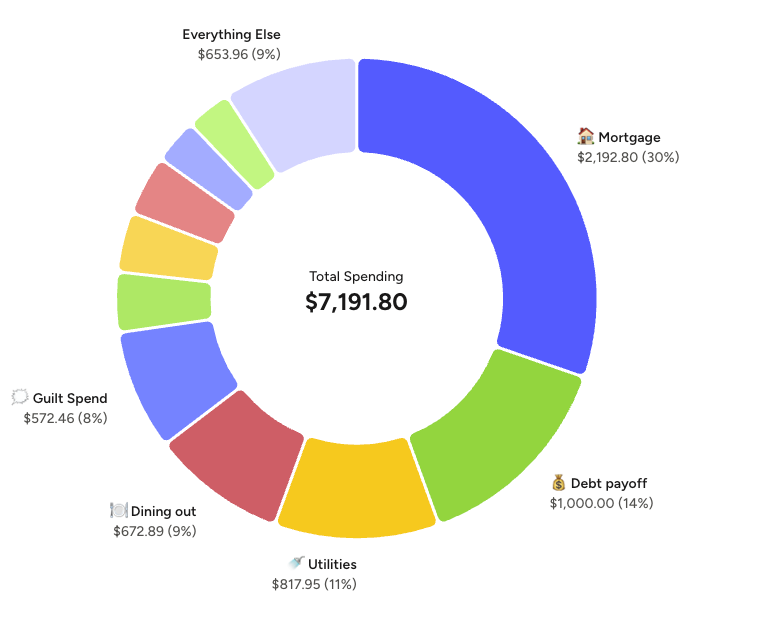

October was a higher-than-average spending month. Part of this was intentional—I invested in a new hobby, 3D printing! I bought a Bambu Lab printer and have been incredibly impressed with it. It's rewarding to design and print small, useful parts around the house. However, I also spent a bit too freely on dining out.

- Monthly Gross Income: ~$19,311

- Monthly Post-Tax Income: ~$8,299

- Monthly Spending: ~$7,192

- Monthly Savings: ~$1,107

- Savings Rate: ~13%

A snapshot of my income versus expenses, showing my savings rate in action.

Reflections & The Road Ahead

The biggest win this month wasn't financial; it was starting this blog. The process of structuring my goals and finances for an audience has brought incredible clarity. I feel more optimistic and in control of my journey to $5M than ever before, especially with tools like Projection Lab helping me visualize the path forward.

That said, my spending was too high. While the new 3D printer was a worthwhile investment, the ~$672 on dining out was not. My main priority for November is to rein in spending and get it under the $5.5k-$6k range. This will be a challenge with Thanksgiving and Black Friday on the horizon, but it's a necessary course correction. My other goal is to get two months ahead on funding in YNAB, covering December and January upfront to create a stronger buffer.

Crossing the $2M mark, even briefly, was a huge psychological boost. Now, it's time to be disciplined, stick to the plan, and keep tracking the progress month over month.

Join the Quest

This blog is my public commitment to the grind from $2M to $5M. If you're a high-earner who feels trapped on the corporate hamster wheel, subscribe and follow along. Let’s figure this out together.

Member discussion